Introduction

The 'Linkly Cloud' is a system developed by Linkly as a hosted payment integration system, where the POS and PIN pad connect securely to our systems, enabling clients to use our systems without requiring our software to be installed in-house. This allows a POS and PIN pad to be completely independent of each other and for the PIN pad to connect to the customer's internet connection instead of to the POS via serial or USB port. The Linkly Cloud REST API is an interface developed by Linkly to interface to our cloud-hosted EFT Clients in a clean, modern, web standards-compliant way. To use the Linkly Cloud REST API the POS must also use the Linkly Cloud product. There is no REST interface for EFT-Clients installed in-house.

The advantages of this system are:

- The POS machine does not run any Linkly software.

- The PIN pad does not connect to a machine in the store. It is connected to the store's network via Ethernet cable or wi-fi and the PIN pad connects to the Linkly data center over an internet connection.

- The REST interface is easier to implement and maintain than other methods of connecting.

- The EFT Clients are hosted securely in an environment that is always kept up to date with the latest security patches.

- With a good redundant Internet connection (e.g. fibre with 4G backup), it can be just as stable as a standalone or traditional integrated PIN pad, if not more so.

Start Developing

Technical Requirements

- The POS must support TLS connections to the API, and must also support the SNI TLS extension. If SNI is not supported, the POS may get certificate errors.

- The POS must validate the cloud SSL certificate to ensure that it is valid. Invalid certificates should fail.

- The POS must resolve the DNS entry for the API addresses above for each connection attempt. The DNS mapping may change between attempts.

- The usernames and passwords should be kept secure. They are required when the operator pairs a new PIN pad.

- Session connectivity:

- A unique session ID must be randomly generated using standard UUID v4 generating algorithms for each and every session made by the POS, even if a previous session was not successful. Duplicate session IDs will be rejected.

- Security upgrades

- The POS may be required to support future TLS extensions or protocol versions if it is deemed that there are security risks in current protocols.

- The POS should be configured to update certificate revocation lists and other OS-level security upgrades to protect the integrity of financial transactions.

- The POS may be required to support future TLS extensions or protocol versions if it is deemed that there are security risks in current protocols.

- To develop for the Linkly Cloud REST API, you will require:

Accounts and Resources

Development requires an account in the Linkly Cloud sandbox environment and the Linkly Virtual PIN pad that simulates a bank PIN pad.

- Linkly Cloud test account

- For development you should request a cloud test account from Linkly. The detailed steps to request one are mentioned in Appendix F - Cloud Account

- You will need one account per PIN pad used for either production or testing.

- For production, customers must contact their bank to set up a new production cloud account.

- Linkly Virtual PIN pad

- Developers may request a copy of the Linkly Virtual PIN pad (for development only), a software application that emulates Linkly Cloud-enabled PIN pad behaviour. The steps to setup a virtual PIN pad are mentioned in Appendix G - Virtual PIN pad.

- Production PIN pads and hardware developer PIN pads must be ordered through your bank. PIN pads must be able to support Linkly Cloud, contact your bank to confirm.

- Sample code for the Linkly Cloud REST API can be viewed on Github

Please direct any questions on the Linkly Cloud REST API to [email protected]

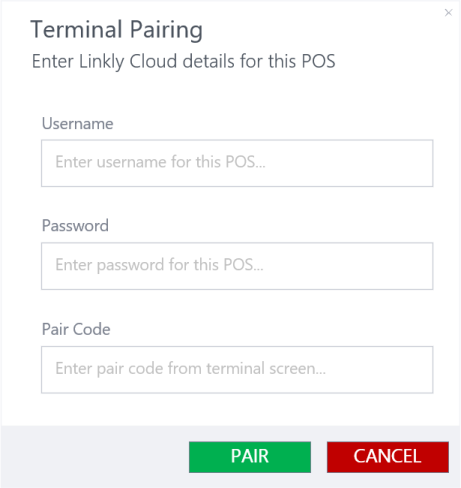

Cloud PIN pad Pairing

Whether you choose to use a hardware PIN pad or our Virtual PIN pad, you will first need to pair the PIN pad. PIN pad pairing refers to the process of using a Linkly Cloud username, password and temporary pairing code to connect the PIN pad to an account on our hosted back-end services. The pairing process generates a secret which allows the POS to initiate transactions on that specific PIN pad. See Authentication for details.

An example of the basic PIN pad pairing process is below:

- Obtain a Cloud EFT Client username and password from Linkly for either Sandbox or Production (depending on whether you have a test or production PIN pad, respectively).

- Plug the PIN pad in and connect to the Internet via cable or Wi-fi depending upon the EFTPOS hardware.

- Set the PIN pad up to connect to the Linkly cloud. Each bank may have different configuration settings.

- Once connected, the PIN pad will display a temporary 'pair code'

- The POS should now send a 'pairing request' using the username, password, and PIN pad 'pair code' from the PIN pad

- The response to the 'pairing request' is a secret which should be stored securely by the POS. This secret does not expire, and will be valid until the account password changes, or the PIN pad is paired to another POS.

- The POS can now do a sale:

- Get a REST authentication token using the secret. If the POS already has a token from a previous session it may use it until ExpirySeconds is up, or alternatively a new token may be requested for each transaction.

- Check that a valid token is received

- Do a sale using the specification below

- Wait for the transaction response, either as an HTTP response to the original transaction request (

async=false), or as a postback from the API (async=true)

Example Pairing UI

Authentication

The Linkly Cloud REST API uses a two-step authentication process.

Step 1 - PIN pad pairing request

The POS pairs with a PIN pad using the Linkly Cloud username, password, and a temporary 'pair code' which is displayed on the PIN pad. This is a one-time request which returns a non-expiring secret. This secret remains valid until either the Linkly Cloud password changes, or another POS pairs with the same PIN pad.

Step 2 - Auth Token request

The POS uses the secret obtained from step 1 to perform a token request to the Linkly Cloud authentication service. The result of this request is a token which can be used to perform a transaction on the PIN pad.

PIN pad pairing request

PIN pad pairing request

# replace <<username>>, and <<password>> with your own credentials

# replace <<paircode>> with the paircode displayed on the PIN pad

curl "https://auth.sandbox.cloud.pceftpos.com/v1/pairing/cloudpos" \

-X POST \

-H 'Content-Type: application/json' \

-H 'Accept: application/json' \

-d '{

"username": "<<username>>",

"password": "<<password>>",

"paircode": "<<paircode>>"

}'

// replace <<username>>, and <<password>> with your own credentials

// replace <<paircode>> with the paircode displayed on the PIN pad

var requestContent = new

{

Username = "<<username>>",

Password = "<<password>>",

PairCode = "<<paircode>>"

};

var request = new HttpRequestMessage(HttpMethod.Post, "https://auth.sandbox.cloud.pceftpos.com/v1/pairing/cloudpos")

{

Content = new StringContent(Newtonsoft.Json.JsonConvert.SerializeObject(requestContent), System.Text.Encoding.UTF8, "application/json")

};

var httpClient = new HttpClient(); // Note: in production don't create multiple HttpClient instances. Share one single instance.

HttpResponseMessage httpResponse = await httpClient.SendAsync(request);

string responseContent = await httpResponse.Content.ReadAsStringAsync();

import requests; # http://python-requests.org

# replace <<username>>, and <<password>> with your own credentials

# replace <<paircode>> with the paircode displayed on the PIN pad

request_payload = {

'username': '<<username>>',

'password': '<<password>>',

'pairCode': '<<paircode>>'

}

response = requests.post('https://auth.sandbox.cloud.pceftpos.com/v1/pairing/cloudpos', json=request_payload)

response_payload = response.json()

URI Path

Production:

POST https://auth.cloud.pceftpos.com/v1/pairing/cloudpos

Development Sandbox environment:

POST https://auth.sandbox.cloud.pceftpos.com/v1/pairing/cloudpos

Headers

| Parameter | Value |

|---|---|

| Content-Type | application/json |

| Accept | application/json |

Request Body

Example PIN pad pairing request object

{

"username": "123456789",

"password": "QWERTY",

"pairCode": "09876"

}

| Field KeyName | Required | Description |

|---|---|---|

| Username | Yes | The Linkly Cloud username |

| Password | Yes | The Linkly Cloud password |

| PairCode | Yes | The pair code displayed on the PIN pad in "pairing" mode |

Status Codes

| Code | Description | Required action |

|---|---|---|

| 200 | Pairing was successful. The response object will contain the secret. | The POS store the secret securely. |

| 401 | The username, password, or paircode was invalid. | Re-check the Cloud username, try resetting the Cloud password |

| 400 | Invalid request. | Correct the request and try again. |

| 408 | Request Timeout. This should be rare: a transient error has occurred, possibly due to server overloading. | Wait a few seconds and attempt the request again. If the problem persists, contact Linkly Support. |

| 500-599 | A server error has occurred. | Wait a few seconds and attempt the request again. If the problem persists, contact Linkly Support. |

PIN pad Pairing Response

Example PIN pad Pairing response object

{

"secret":"R6pqwt5ThZkjDXa7WA9aAgXUcAyGjX6a"

}

| Field KeyName | Description |

|---|---|

| secret | The non-expiring secret the POS uses to request an auth token |

Auth Token Request

Token request

# replace <<secret>> with the secret returned from the cloud pairing process

# replace <<posName>> and <<posVersion>> with the name and version of your POS

# replace <<posId>> with a unique UUID v4 which identifies your POS instance

# replace <<posVendorId>> with the unique UUID v4 which identifies your POS product

curl "https://auth.sandbox.cloud.pceftpos.com/v1/tokens/cloudpos" \

-X POST \

-H 'Content-Type: application/json' \

-H 'Accept: application/json' \

-d '{

"secret": "<<username>>",

"posName": "<<posName>>",

"posVersion": "<<posVersion>>",

"posId": "<<posId>>",

"posVendorId": "<<posVendorId>>"

}'

// replace <<secret>> with the secret returned from the cloud pairing process

// replace <<posName>> and <<posVersion>> with the name and version of your POS

// replace <<posId>> with a unique UUID v4 that identifies your POS instance

// replace <<posVendorId>> with the unique UUID v4 which identifies your POS product

var requestContent = new

{

Secret = "<<secret>>",

PosName = "<<posName>>",

PosVersion = "<<posVersion>>",

PosId = "<<posId>>",

PosVendorId = "<<posVendorId>>",

};

var request = new HttpRequestMessage(HttpMethod.Post, "https://auth.sandbox.cloud.pceftpos.com/v1/tokens/cloudpos")

{

Content = new StringContent(Newtonsoft.Json.JsonConvert.SerializeObject(requestContent), System.Text.Encoding.UTF8, "application/json")

};

var httpClient = new HttpClient(); // Note: in production don't create multiple HttpClient instances. Share one single instance.

HttpResponseMessage httpResponse = await httpClient.SendAsync(request);

string responseContent = await httpResponse.Content.ReadAsStringAsync();

import requests; # http://python-requests.org

# replace <<secret>> with the secret returned from the cloud pairing process

# replace <<posName>> and <<posVersion>> with the name and version of your POS

# replace <<posId>> with a unique UUID v4 that identifies your POS instance

# replace <<posVendorId>> with the unique UUID v4 which identifies your POS product

request_payload = {

'secret': '<<secret>>',

'posName': '<<posName>>',

'posVersion': '<<posVersion>>',

'posId': '<<posId>>',

'posVendorId': '<<posVendorId>>',

}

response = requests.post('https://auth.sandbox.cloud.pceftpos.com/v1/tokens/cloudpos', json=request_payload)

response_payload = response.json()

URI Path

Production:

POST https://auth.cloud.pceftpos.com/v1/tokens/cloudpos

Development Sandbox environment:

POST https://auth.sandbox.cloud.pceftpos.com/v1/tokens/cloudpos

Headers

| Parameter | Value |

|---|---|

| Content-Type | application/json |

| Accept | application/json |

Request Body

Example token request object

{

"secret": "R6pqwt5ThZkjDXa7WA9aAgXUcAyGjX6a",

"posName": "Test POS",

"posVersion": "12.6.80.17",

"posId": "3e7f5001-58a3-43fa-9129-6e84a7b4f2a0",

"posVendorId": "a256b7ec-709d-4c7d-8ffe-57cc7ca1fd22",

}

| Field KeyName | Required | Description |

|---|---|---|

| Secret | Yes | The secret returned from the cloud pairing process |

| PosName | Yes | The name of the POS requesting the token |

| PosVersion | Yes | The version of the POS requesting the token |

| PosId | Yes | A unique UUID v4 which identifies the POS instance. This value is generated by the POS as a part of the POS deployment settings. e.g. Two registers at the same merchant should supply two different PosId values |

| PosVendorId | Yes | A unique UUID v4 which identifies the POS POS product. This value can be hard coded into the build of the POS. e.g. All merchants using the same POS product should supply the same posVendorId value |

Status Codes

| Code | Description | Required action |

|---|---|---|

| 200 | Authorisation was successful. The response object will contain the auth token. | Store and maintain the token based on the expirySeconds property. |

| 401 | The secret was invalid. | You will need to perform the PIN pad pairing process again |

| 400 | Invalid request. | Correct the request and try again. |

| 408 | Request Timeout. This should be rare: a transient error has occurred, possibly due to server overloading. | Wait a few seconds and attempt the request again. If the problem persists, contact Linkly Support. |

| 500-599 | A server error has occurred. | Wait a few seconds and attempt the request again. If the problem persists, contact Linkly Support. |

Auth Response

Example token response object

{

"token":"x2MUks9vdreTp8aHjfcULkQxURurcRCb",

"expirySeconds":86400

}

| Field KeyName | Description |

|---|---|

| token | The token to user for authentication. |

| expirySeconds | The number of seconds until the token expires. |

Using the token

The Bearer token is added to each request as an HTTP header with the keyword Bearer as shown below:

Authorization: Bearer <token goes here>

When a token is received from the Linkly Authentication service it is the responsibility of the POS to securely store and manage the lifetime of that token and request a new one when the old token has expired.

The expirySeconds is returned with each token response. This value indicates the number of seconds until the token expires. The POS can use this value to calculate and record the local expiry date and time.

We recommend requesting a new token if it is due to expire within a few minutes of the request.

The POS can request tokens as often as required, however if the POS requests a new token for each transaction or each request this will slow down transaction times. Be aware that requesting a new token does not currently cause existing valid tokens to be revoked, but this may change in future without warning.

During an async transaction, be aware that if the token expires mid-transaction it will need to be renewed if the POS needs to send a sendkey request to the PIN pad.

C# example: checks to see if the token has expired

class TokenResponse

{

public string Token { get; set; }

public double ExpiryMinutes {

get

{

return (ExpiryDateTime - DateTime.UtcNow).TotalMinutes;

}

set

{

ExpiryDateTime = DateTime.UtcNow.AddMinutes(value);

}

}

public DateTime ExpiryDateTime { get; set; } = DateTime.UtcNow;

}

TokenResponse token = null;

private async Task<T> PostRequestAsync<T>(Uri baseUri, Guid sessionId, string type, EFTRequest request, bool async)

{

var httpClient = GetHttpClient(); // Get a pre-constucted HttpClient from some repository, factory, or static instance

if (token == null || token.ExpiryDateTime < DateTime.UtcNow.AddSeconds(10)) // notice 10 second offset

{

token = await GetTokenAsync(appSettings.PinpadUsername, appSettings.PinpadPassword, appSettings.PinpadPairCode);

if (token == null || string.IsNullOrWhiteSpace(token.Token))

{

throw new Exception("Failed to get valid token");

}

}

var uri = new Uri(baseUri, $"sessions/{sessionId}/{type}?async={async.ToString().ToLower()}");

var request = new HttpRequestMessage()

{

RequestUri = new Uri("http://www.someURI.com"),

Method = HttpMethod.Post,

};

request.Headers.Accept.Add(new System.Net.Http.Headers.AuthenticationHeaderValue("Bearer", token.Token);

HttpContent content = new StringContent(JsonConvert.SerializeObject(request), UTF8Encoding.UTF8, "application/json");

var response = await httpClient.SendAsync(request);

if (response.IsSuccessStatusCode)

{

if (async)

{

return default(T); // nothing to return, now it's time to wait for the postbacks

}

return JsonConvert.DeserializeObject<T>(await response.Content.ReadAsStringAsync());

}

else

{

switch (response.StatusCode)

{

case System.Net.HttpStatusCode.Unauthorized:

throw new UnauthorizedAccessException("Looks like the username, password or pair code is no longer valid, or your account has been disabled. Try re-pairing the PIN pad or resetting the password.");

case System.Net.HttpStatusCode.NotFound:

throw new Exception("Ooops, this shouldn't happen. Check that your base URI and type are correct.");

case System.Net.HttpStatusCode.BadRequest:

throw new Exception("That request wasn't valid! Inspect the response message to see what's wrong.");

default:

throw new Exception("Server error, timeout, PIN pad error, etc. Call GET /sessions/{id}/transaction to see the status of this transaction or try again later.");

}

}

}

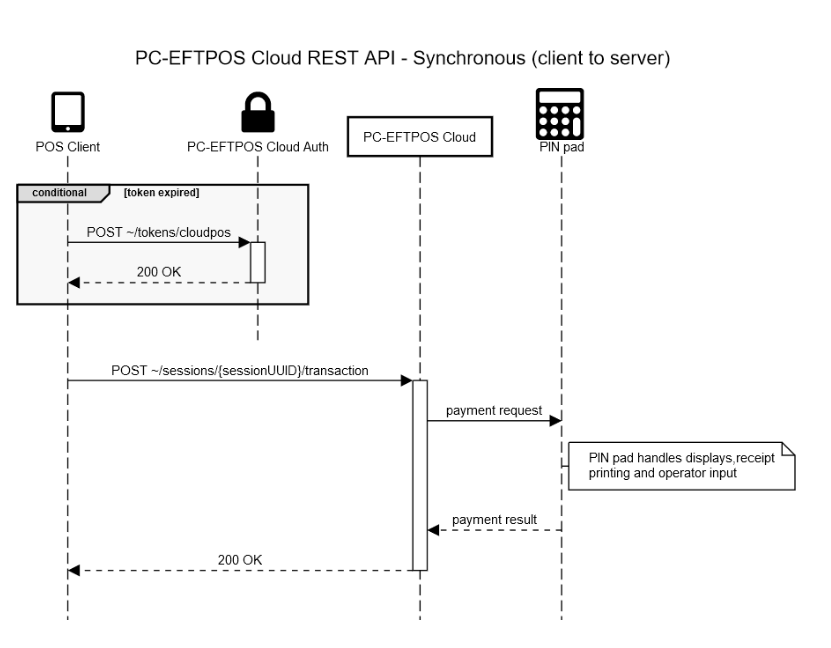

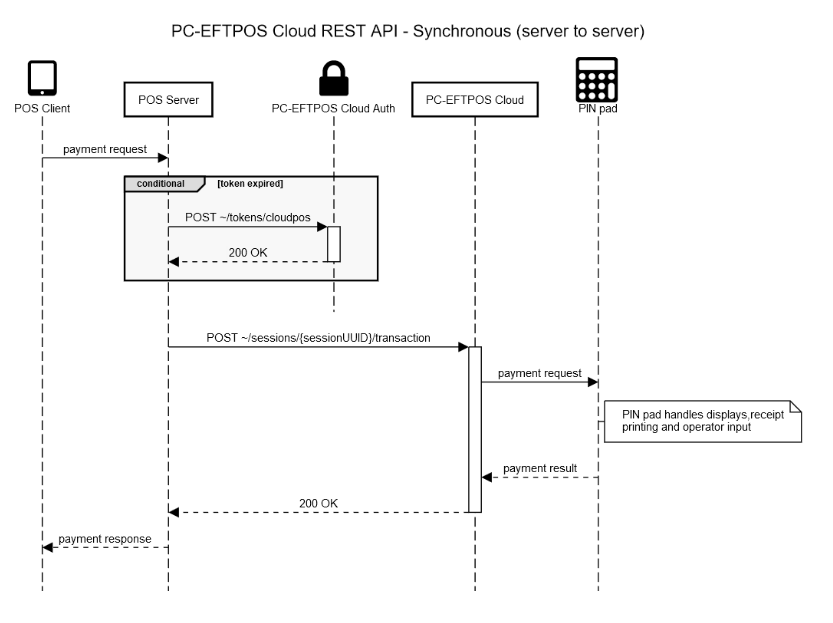

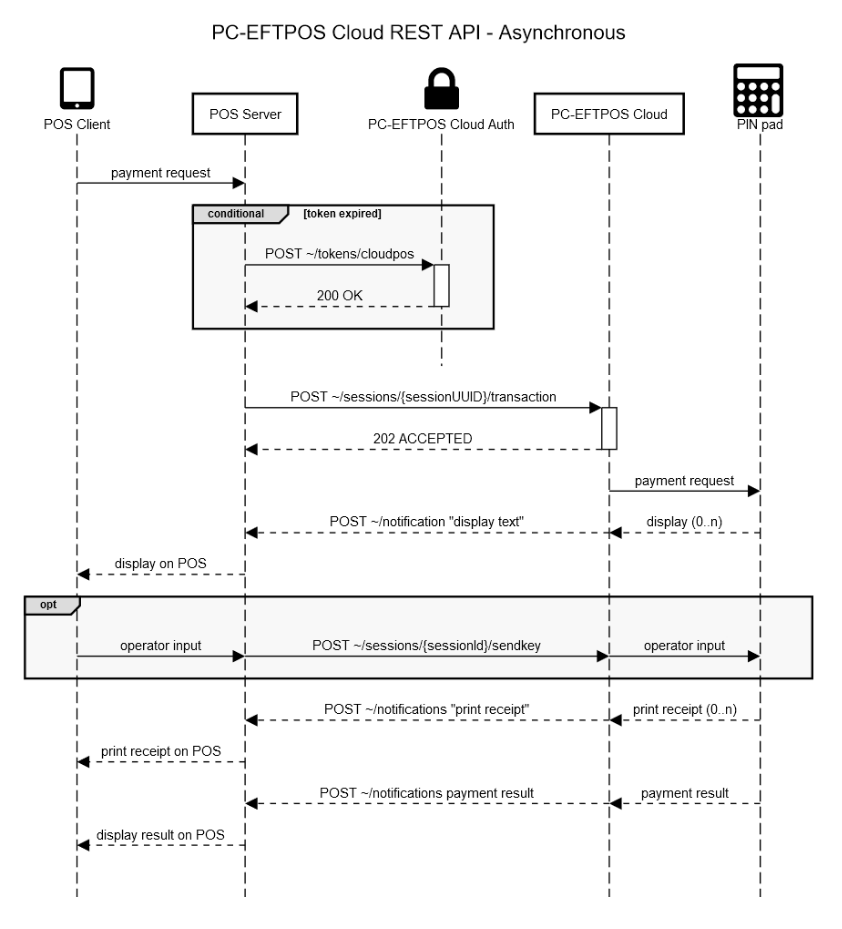

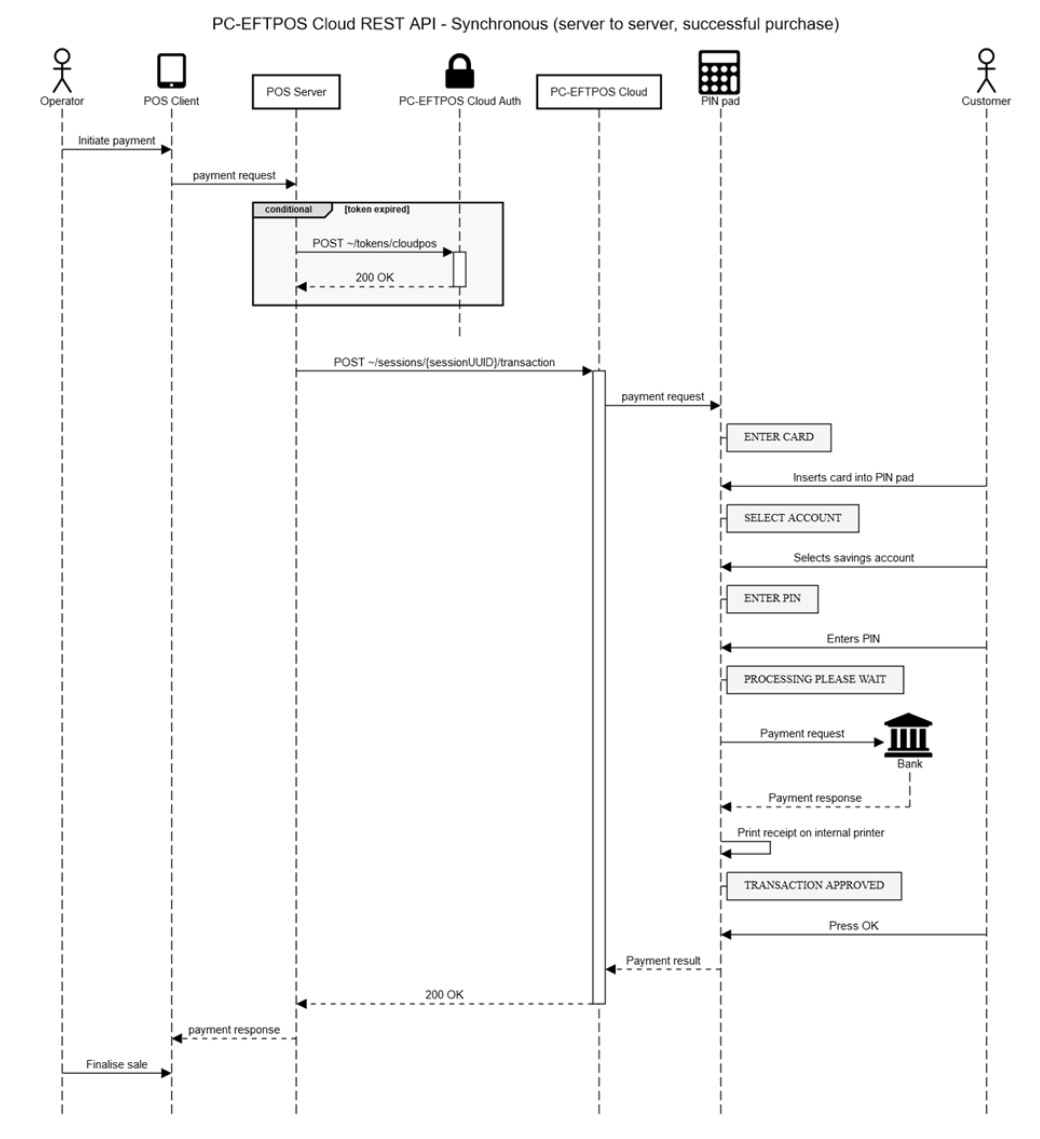

Async vs Sync Mode

The Linkly Cloud REST API works using one of the two following methods, synchronous and asynchronous. The mode is selected when POSTing a request by using the URI parameter async=false or async=true

Synchronous

Synchronous mode is the simplest and supports both POS Server to API or direct POS Client to API communication, however it is more limited in utility as the POS typically gets no feedback on progress of the EFT transaction until the result is returned at the end, indicating success or failure.

- If the POS doesn't have a valid authentication token it requests one from the Linkly Token Authentication service, using credentials provided by Linkly

- The POS sends its request to the API endpoint with the token in the header

- The operator completes the sale on the PIN pad while the POS waits for an HTTP response

- The POS receives a response with the result of the transaction

When using Sync mode the Notification object is not required in the request, although if it is supplied the notifications can still be sent to a separate postback web service if required (e.g. for logging purposes).

Client-to-Cloud API

Linkly Cloud Synchronous API implemented directly from POS client to Linkly Cloud API.

Server-to-Cloud API

Linkly Cloud Synchronous API implemented from POS server to Linkly Cloud API.

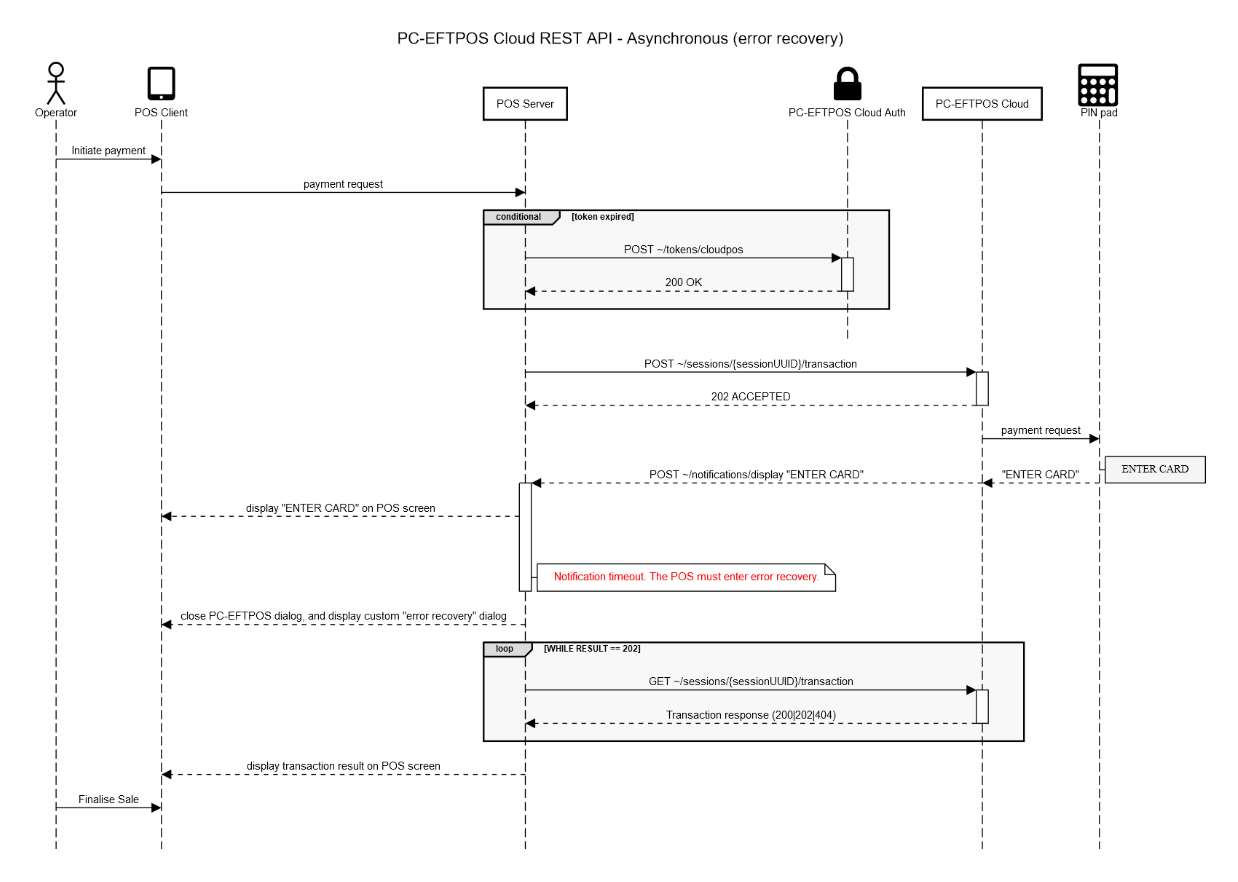

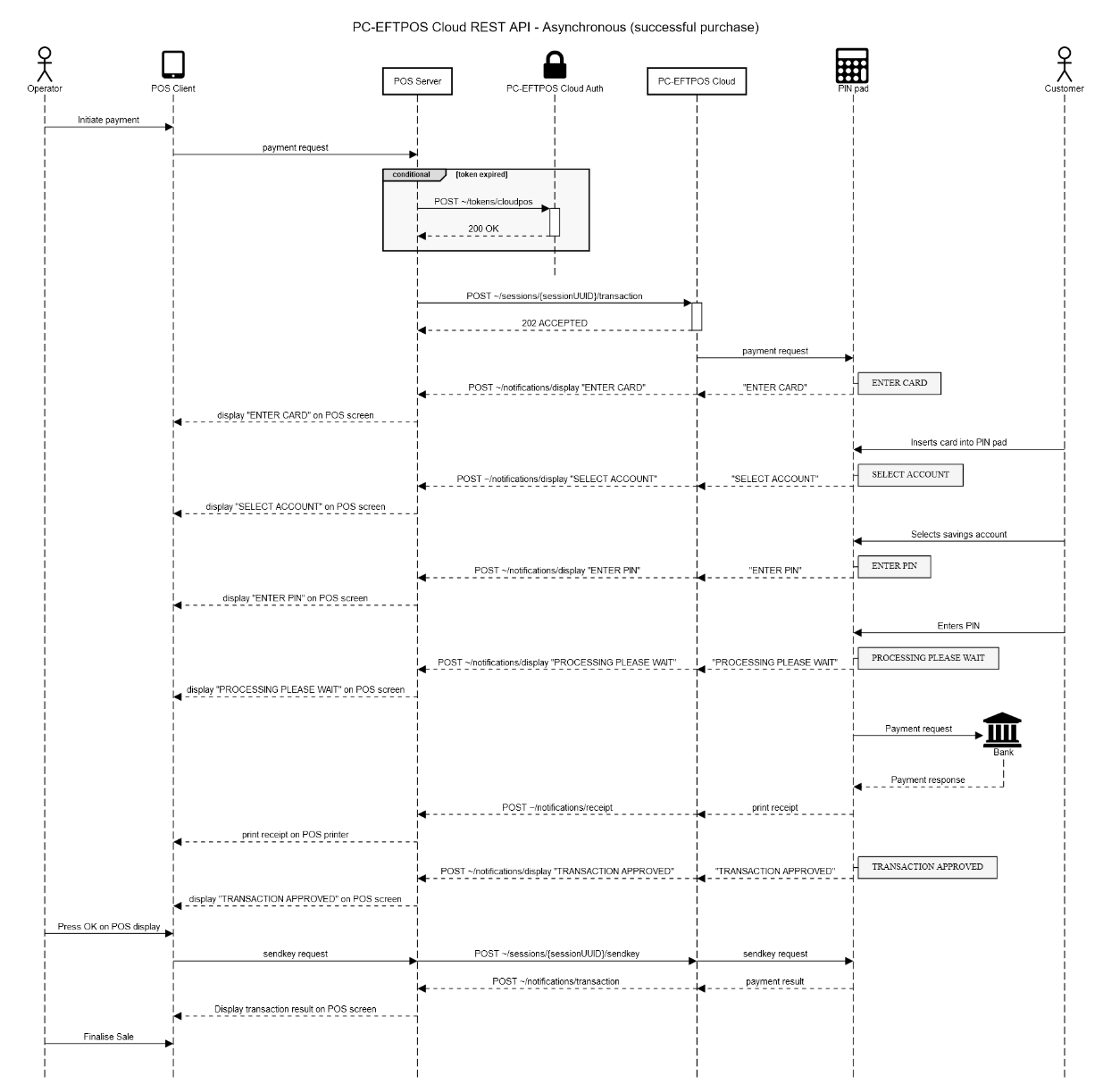

Asynchronous

Asynchronous mode supports POS Server to API communication only, as postbacks to the POS need a publicly accessible Notification URI. We recommend where possible that POS developers use this method, as it provides a better user experience, more functionality (e.g. key presses from the POS and mid-transaction status notifications) and is closer to other Linkly implementations.

- If the POS doesn't have a valid authentication token it requests one from the Linkly Token Authentication service, using credentials provided by Linkly.

- The POS sends its request to the API endpoint with the token in the header. It receives a "202 Accepted" HTTP response if successful, and the transaction begins

- The Linkly Cloud REST API sends postback messages to the provided notification URI each time the PIN pad display changes and each time a receipt is generated. The operator proceeds with the sale

- The POS can optionally POST additional sendkey requests to the PIN pad (to respond to requests for user input) via the REST interface using a valid token and the same session ID used to initiate the transaction. Examples of sendkey requests include "OK", "Cancel", "Yes", etc.

- When the transaction is complete the API sends a postback message indicating transaction completion with the result of the transaction

Server-to-Cloud API

Linkly Cloud Asynchronous API implemented from POS server to Linkly Cloud API.

API Requests

Request URI

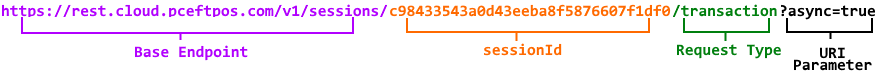

The request URI is made up of 4 parts; the base endpoint, a sessionId, the type of request to make, and the async URI parameter.

- Base endpoints are different for authentication and requests on both production and the test sandbox.

- A

sessionIdis a valid uuid which identifies the current POS request. This must be generated by the POS using standard GUID/UUID generating libraries, ie. this must be a standard, globally unique UUID value for each and every transaction request. - The request type portion of the path needs to be one of the following strings:

| Request Types |

|---|

| transaction |

| logon |

| settlement |

| status |

| querycard |

| configuremerchant |

| reprintreceipt |

| sendkey |

- An API Request object should be constructed and POSTed to the appropriate API endpoint.

- The

asyncparameter needs to reflect the intention of the POS to either sit and wait for a response (async=false) or POST, expecting immediate return, and wait for Notifications to hit the POS's own postback endpoints, as descibed above.

Production Endpoints

For Authentication the POS should sends its token requests to:

https://auth.cloud.pceftpos.com/v1/tokens/cloudpos

The base request API endpoint is:

https://rest.pos.cloud.pceftpos.com/v1/sessions

Examples of complete production URIs:

| URI |

|---|

https://rest.pos.cloud.pceftpos.com/v1/sessions/c98433543a0d43eeba8f5876607f1df0/transaction?async=true |

https://rest.pos.cloud.pceftpos.com/v1/sessions/79e133ee3bc44339abfce86c93951193/logon?async=false |

https://rest.pos.cloud.pceftpos.com/v1/sessions/e6e2c68f217c469e977cddb56592f7ad/settlement?async=true |

https://rest.pos.cloud.pceftpos.com/v1/sessions/bc30254273d74b1dad95ef6426ee3892/status?async=false |

https://rest.pos.cloud.pceftpos.com/v1/sessions/5e833e504d124f4fb31954e76eab7691/querycard?async=true |

https://rest.pos.cloud.pceftpos.com/v1/sessions/795f214fbde645e8a7f7c8ae8dfba4f7/configuremerchant?async=true |

https://rest.pos.cloud.pceftpos.com/v1/sessions/1808c4ebc57a48fe8dba2a55f65b3c28/reprintreceipt?async=false |

https://rest.pos.cloud.pceftpos.com/v1/sessions/ba573b113af3577568546ecb327c0059/sendkey?async=true |

Development Endpoints

For Authentication the POS should sends its token requests to:

https://auth.sandbox.cloud.pceftpos.com/v1/tokens/cloudpos

The base request API endpoint is:

https://rest.pos.sandbox.cloud.pceftpos.com/v1/sessions/

Examples of complete development URIs:

| URI |

|---|

https://rest.pos.sandbox.cloud.pceftpos.com/v1/sessions/c98433543a0d43eeba8f5876607f1df0/transaction?async=false |

https://rest.pos.sandbox.cloud.pceftpos.com/v1/sessions/79e133ee3bc44339abfce86c93951193/logon?async=false |

https://rest.pos.sandbox.cloud.pceftpos.com/v1/sessions/e6e2c68f217c469e977cddb56592f7ad/settlement?async=false |

https://rest.pos.sandbox.cloud.pceftpos.com/v1/sessions/bc30254273d74b1dad95ef6426ee3892/status?async=false |

https://rest.pos.sandbox.cloud.pceftpos.com/v1/sessions/5e833e504d124f4fb31954e76eab7691/querycard?async=false |

https://rest.pos.sandbox.cloud.pceftpos.com/v1/sessions/795f214fbde645e8a7f7c8ae8dfba4f7/configuremerchant?async=false |

https://rest.pos.sandbox.cloud.pceftpos.com/v1/sessions/1808c4ebc57a48fe8dba2a55f65b3c28/reprintreceipt?async=false |

https://rest.pos.sandbox.cloud.pceftpos.com/v1/sessions/ba573b113af3577568546ecb327c0059/sendkey?async=true |

Notifications

Example notification request object

{

"Request": { },

"Notification":{

"Uri": "https://pos.example.com/{{sessionid}}/{{type}}",

"AuthorizationHeader": "Bearer <<token>>"

}

}

The Notification object is only required if the POS uses async mode.

If a Notification object is provided as a part of the request, Linkly Cloud REST API will send information about the request such as displays, receipts and the transaction response to the endpoint specified by the POS

in the Uri field of the notification object.

The object is made up of two fields: Uri and AuthorizationHeader.

| Field KeyName | Description |

|---|---|

| Uri | Contains the Uri to send the responses to (must be https) |

| AuthorizationHeader | (Optional) value to add for the authorization header |

When providing a Notification Uri the POS can include {{sessionid}} and {{type}} in its URI which will be replaced by the session Id of the request and the type of response received, respectively.

Example:

Uri: https://pos.example.com/{{sessionId}}/{{type}}

POSTed with the session Id 12345678-90AB-CDEF-1234-1DECAFCOFFEE:https://rest.pos.sandbox.cloud.pceftpos.com/v1/sessions/12345678-90ab-cdef-1234-1decafcoffee/transaction

The API would send display responses for this transaction to https://pos.example.com/12345678-90ab-cdef-1234-1decafcoffee/display a transaction response would be https://pos.example.com/12345678-90ab-cdef-1234-1decafcoffee/transaction

These fields are optional and can be used without the other, or as a part of the query string. For example:

https://pos.example.com/{{type}}https://pos.example.com/{{sessionId}}https://pos.example.com?type={{type}}https://pos.example.com?sessionId={{sessionId}}https://pos.example.com?sessionId={{sessionId}}&type={{type}}https://pos.example.com/{{sessionId}}?type={{type}}https://pos.example.com/{{type}}?sessionId={{sessionId}}

Error Recovery

Error recovery only applies to the Transaction request and simply refers to performing a GET request to the API to request the Transaction Status, using the same sessionId as the original Transaction request.

The POS must enter error recovery if, on POSTing a transaction request:

- the POS receives an HTTP 500-599 server error, connection error, or timeout whilst waiting for a POSTed transaction response, or

- (async only) a transaction response notification is not received within approximately 3 minutes (regardless of what other notifications might have been received)

In recovery the POS should use the same 'sessionId' as the original transaction to periodically call Transaction Status until one of the following HTTP Status codes is received:

- 200 OK - this response should include an APIResponse

- 400 Invalid Request - this is an error condition indicating that the Transaction Status request was invalid. Do not retry, log it and return an error to the operator (the transaction result cannot be determined).

- 401 Unauthorised - try getting a new token and then continue. If this persists, abort (the password may have changed).

- 404 Not Found - Either the Transaction Status URI used was incorrect (check configuration) or the transaction was not submitted successfully and can be resubmitted safely.

Any other HTTP status code (202, 408, 500-599) should mean the POS continues to retry. See Exponential Backoff for details and an example.

Example

- You POST a transaction to

https://rest.pos.sandbox.cloud.pceftpos.com/v1/sessions/c98433543a0d43eeba8f5876607f1df0/transaction - You receive an HTTP error 408 indicating that the request has timed out. This does not specify whether or not the transaction succeeded.

- You enter recovery mode and start polling GET

https://rest.pos.sandbox.cloud.pceftpos.com/v1/sessions/c98433543a0d43eeba8f5876607f1df0/transactionevery few seconds. - You receive an HTTP 202 each time indicating the transaction is still in progress.

- Eventually you receive an HTTP 200 with a valid transaction response. The transaction reponse object (not the HTTP Status code) indicates the financial success of the transaction.

The error recovery can end when either:

- The POS receives an HTTP 200 "OK" with a valid transaction response,

- The POS receives an HTTP 404 "Resource not found" response, which (assuming the correct GET request URI is used) indicates that the original transaction was not processed, or

- The POS receives an HTTP 400 "Invalid request" response, indicating an invalid POS request which should be investigated and resolved.

All other HTTP response codes indicate that, in one way or another, the POS should keep trying to GET the transaction response, as outlined below.

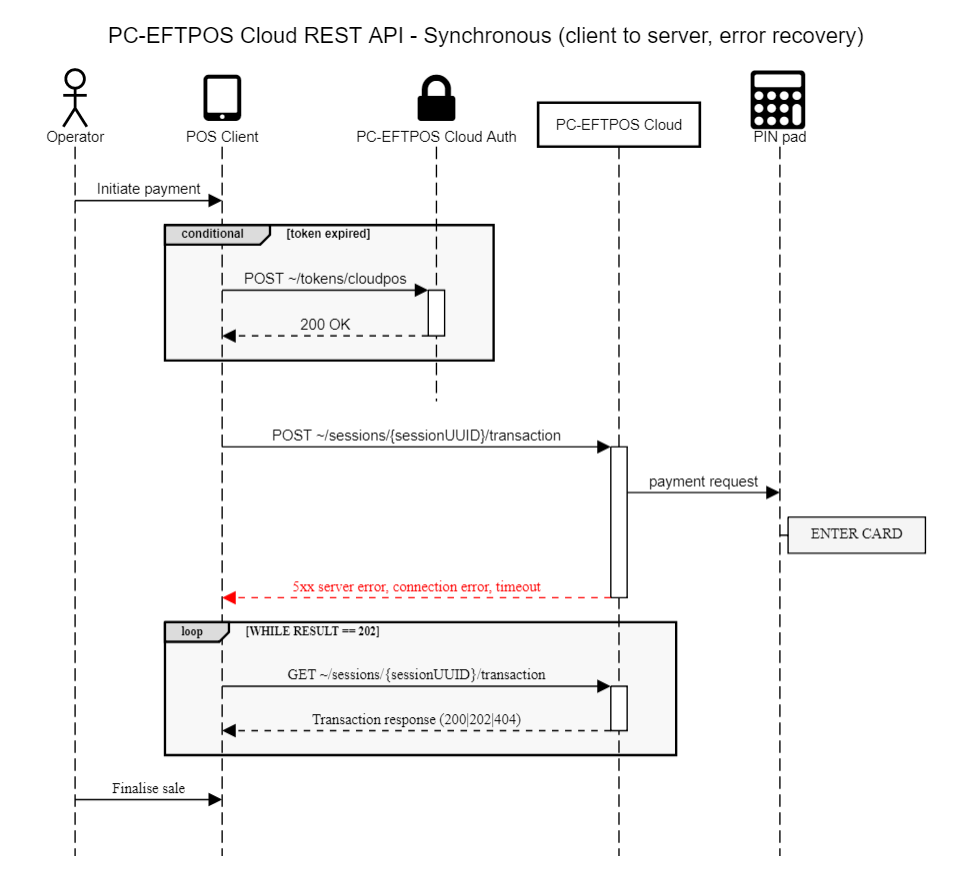

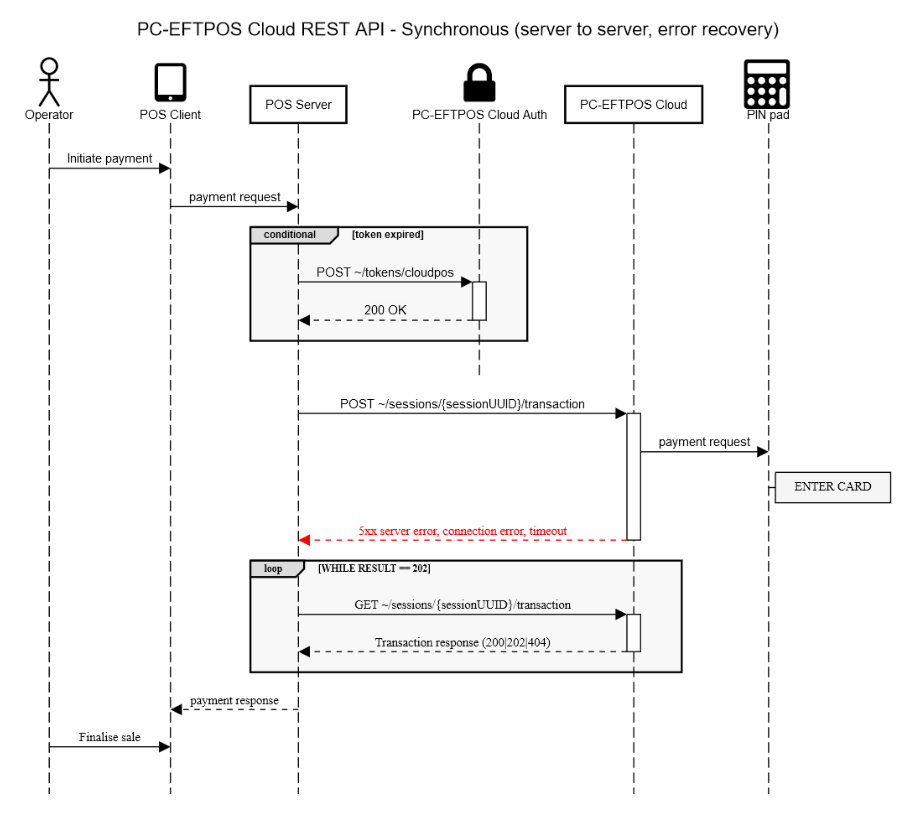

Sync Mode Recovery

The error recovery sequence diagrams for both client-to-cloud and server-to-cloud synchronous mode of communication is shown below.

Client-to-Cloud error recovery

Server-to-Cloud error recovery

HTTP Response codes returned from Transaction Status.

| HTTP Code | Description | Required action |

|---|---|---|

| 200 | OK - This will be accompanied by a valid response. The 'success' property in the response object indicates the financial status of the transaction. | Inspect the response to check the result of the financial transaction (eg. Approved, Declined, Approve with signature, etc.) |

| 202 | Accepted - The original transaction has been received but is not yet complete. Response body will be null. | The POS should retry the GET request every 1-2 seconds for up to 3 minutes, or until another HTTP code is received. |

| 400 | Invalid request - This error does NOT indicate success or failure of the original transaction, but rather that the GET request is badly formed. It is likely that the session Id is not a valid UUID. | Do NOT retry this GET request, as it is incorrectly formed. |

| 401 | Unauthorised - The token supplied is invalid. This error does NOT indicate success or failure of the original transaction. | The POS should refresh the token and attempt the GET request again. |

| 404 | Resource not found - Either the GET request URI is incorrect (the endpoint was not found) or the session Id requested was not found, hence the original transaction was not submitted successfully. | So long as the Transaction Status URI is configured correctly, the POS can safely retry the original transaction with the same (or new) sessionId. |

| 408 | Request Timeout - This should be rare: a transient error has occurred, possibly due to server overloading. | The POS should retry the GET request every few seconds for up to 3 minutes, or until another code is received. Please use exponential backoff to avoid overloading the server further. |

| 500-599 | A server error has occurred. | The POS should continue to perform the GET request using exponential backoff to avoid overloading the server. |

Async Mode Recovery

The POS must enter error recovery if no transaction response postback notifications are received from the Linkly Cloud within 3 minutes, even if all other responses (receipts/displays...) have been received.

HTTP Response codes returned from Transaction Status.

| HTTP Code | Description | Required action |

|---|---|---|

| 200 | OK - This will be accompanied by a valid response. The 'success' property in the response object indicates the financial success of the transaction. | Inspect the response to check the result of the financial transaction (eg. Approved, Declined, Approve with signature, etc.) |

| 202 | Accepted - The original transaction has been received but is not yet complete. Response body will be null. | The POS should await the result in its notification postback, or retry the GET request every 1-2 seconds for up to 3 minutes or until another HTTP code is received. |

| 400 | Invalid request - This error does NOT indicate success or failure of the original transaction, but rather that the GET request is badly formed. It is likely that the session Id is not a valid UUID. | Do NOT retry this GET request, as it is incorrectly formed. |

| 401 | Unauthorised - The token supplied is invalid. This error does NOT indicate success or failure of the original transaction. | The POS should refresh the token and attempt the request again. |

| 404 | Resource not found - Either the GET request URI is incorrect (the endpoint was not found) or the session Id requested was not found, hence the original transaction was not submitted successfully. | So long as the Transaction Status URI is configured correctly, the POS can safely retry the original transaction with the same (or new) sessionId. |

| 408 | Request Timeout - This should be rare: a transient error has occurred, possibly due to server overloading. | The POS should retry the GET request every few seconds for up to 3 minutes, or until another code is received. Please use exponential backoff to avoid overloading the server further. |

| 500-599 | A server error has occurred. | The POS should continue to perform the GET request using exponential backoff to avoid overloading the server. |

Exponential backoff

Exponential backoff is a technique used to reduce added strain on already overloaded servers, networks or infrastructure. It refers to the process of increasing the delay between each subsequent request, starting with a short delay and working up to a longer delay if the error condition continues. We request that if you get a response from our servers that may indicate overloading that you employ basic exponential backoff in your recovery attempts.

In-depth example:

- You POST a transaction to

https://rest.pos.sandbox.cloud.pceftpos.com/v1/sessions/c98433543a0d43eeba8f5876607f1df0/transaction - You receive an HTTP error 408 indicating that the request has timed out. This does not specify whether or not the transaction succeeded.

- You enter recovery mode and immediately try to GET the Transaction Status from

https://rest.pos.sandbox.cloud.pceftpos.com/v1/sessions/c98433543a0d43eeba8f5876607f1df0/transaction - You receive another HTTP 408. You delay 1 second and try the GET request again (initial delayed attempt).

- You receive another HTTP 408. You delay 2 seconds and try the GET request again (backoff by doubling delay).

- You receive another HTTP 408. You delay 4 seconds and try the GET request again (backoff by doubling delay again).

- You receive an HTTP 404 error indicating that the original transaction was NOT SUCCESSFUL, ie. the sessionId was not found. You can now exit recovery mode and retry the original transaction, POSTing a transaction to

https://rest.pos.sandbox.cloud.pceftpos.com/v1/sessions/c98433543a0d43eeba8f5876607f1df0/transactionagain. - You receive an HTTP error 408 indicating that the request has timed out. This does not specify whether or not the transaction succeeded.

- You enter recovery mode again and immediately GET from

https://rest.pos.sandbox.cloud.pceftpos.com/v1/sessions/c98433543a0d43eeba8f5876607f1df0/transaction - You receive another HTTP 408. You delay 1 second and try the GET request again.

- You receive another HTTP 408. You delay 2 seconds and try the GET request again.

- You receive an HTTP 202 indicating that the transaction is in progress. You keep trying the GET request every second, as long as you get a 202 (not an error condition, so backoff not required).

- You receive an HTTP 200 with a valid response indicating the financial success of the transaction.

Core Payments

Overview

The Core Payments API offers a simple entry point for POS developers to send card payment transactions to Linkly supported PIN pads.

Security

All communications between the third-party provider and Linkly are encrypted with TLS 1.2. All communications between the lane and Linkly Cloud are encrypted with TLS 1.2.

Supported Cipher Suites - TLS_ECDHE_RSA_WITH_AES_256_GCM_SHA384 - TLS_ECDHE_RSA_WITH_CHACHA20_POLY1305_SHA256 - TLS_ECDHE_RSA_WITH_AES_128_GCM_SHA256

Minimum Requirements

Below are the minimum requirements for a POS system to be considered for accreditation with the Linkly Core Payments API

Transaction Types

Management of merchant/bank functions

Transactional Scenarios

Error Handling

Purchase

The purchase transaction type allows the merchant to perform a sale, it uses the transaction request format.

All refunds in the Core Payments API need to be matched to an original purchase. The POS will achieve this by storing the contents of the RFN PAD tag returned in the purchase response and, if a refund for this purchase is required, sending the contents of this field in the refund request.

The 'REF' tag represents the transaction reference from the payment host. It will be printed on the receipt. The POS should record the 'REF' tag against the sale in the POS database to allow a transaction to be looked up from the receipt contents.

Purchase Request

Example transaction request object

{

"Request":

{

"Merchant": "00",

"TxnType": "P",

"AmtPurchase": 100,

"TxnRef": "1234567890",

"CurrencyCode": "AUD",

"CutReceipt": "0",

"ReceiptAutoPrint": "0",

"Application": "00",

"PurchaseAnalysisData":

{

"OPR": "00766|test",

"AMT": "0042000",

"PCM": "0000"

},

"Basket":

{

"id": "t39kq18134553",

"amt": 2145,

"tax": 200,

"dis": 50,

"sur": 0,

"items": [{

"id": "t39kq002",

"sku": "k24086723",

"qty": 2,

"amt": 2145,

"tax": 200,

"dis": 50,

"name": "XData USB Drive"

}]

}

},

"Notification":

{

"Uri": "https://myPos.com.au/{{sessionid}}/{{type}}",

"AuthorizationHeader": "Bearer <<token>>"

}

}

Below are the fields from the transaction request that must be set for a purchase transaction.

| Field Name | Type | Required value | Notes |

|---|---|---|---|

| Merchant | string(2) | '00' | Instructs the Linkly components to perform a card payment |

| TxnType | string(1) | 'P' | Purchase |

| AmtPurchase | number | Variable | Left zero filled, amount of sale in cents. |

| TxnRef | string(16) | Variable | The reference number to attach to the transaction. This will appear on the receipt. |

| CurrencyCode | string(3) | Variable | Code to indicate requested currency. e.g. 'AUD' |

| CutReceipt | string(1) | Variable | Indicates whether Linkly should cut receipts. Defaults to '0' (DontCut) |

| ReceiptAutoPrint | string(1) | Variable | Indicates if the POS is to receive receipt events. See ReceiptAutoPrint for available values |

| Application | string(2) | '00' | Instructs Linkly to perform a card payment |

| PurchaseAnalysisData | object | Variable | Extended fields. See PurchaseAnalysisData note below. |

| Basket | object | Variable | See basket section for details |

PurchaseAnalysisData

| Tag | Name | Type | Notes | Example |

|---|---|---|---|---|

| OPR | OperatorReference | string(128) | POS operator name and id. Format: ID|Name | {"OPR": "66|test" } |

| AMT | TotalAmount | string(9) | Total amount of the entire sale in cents, not Tender amount | {"AMT": "20000" } $200.00 total sale |

| PCM | POSCapabilitiesMatrix | string(128) | POS Capabilities Matrix. First byte = POS can scan Barcode | {"PCM": "0000"} |

Purchase Response

Example purchase response object

{

"SessionId": "dd250a0c81c202b66220d7379b338b8f",

"ResponseType": "transaction",

"Response": {

"TxnType": "P",

"Merchant": "00",

"CardType": "AMEX CARD ",

"CardName": "05",

"RRN": "123456789012",

"DateSettlement": "2018-07-31T00:00:00",

"AmtCash": 0,

"AmtPurchase": 100,

"AmtTip": 0,

"AuthCode": 123456,

"TxnRef": "1234567890 ",

"Pan": "37601234567890 ",

"DateExpiry": "4909",

"Track2": "37601234567890=0949?,,S, YES, 05?????? ",

"AccountType": "2",

"TxnFlags": {

"Offline": "1",

"ReceiptPrinted": "0",

"CardEntry": "S",

"CommsMethod": "0",

"Currency": "0",

"PayPass": "0",

"UndefinedFlag6": "0",

"UndefinedFlag7": "0"

},

"BalanceReceived": false,

"AvailableBalance": 0,

"ClearedFundsBalance": 0,

"Success": true,

"ResponseCode": "00",

"ResponseText": "APPROVED ",

"Date": "2018-07-31T16:14:40",

"Catid": "12345678",

"Caid": "0987654321 ",

"Stan": 0,

"PurchaseAnalysisData": {

"RFN": "klujhadsc9ph87asd",

"REF": "12345",

"HRC": "ERR1",

"HRT": "INVALID CARD"

}

}

}

The purchase response is in the format of the transaction response object, see the Transaction section for a detailed breakdown. The below tags are part of the PurchaseAnalysisData object in the response and are of critical importance to the core payments transactions.

PurchaseAnalysisData

| Tag | Name | Type | Notes | Example |

|---|---|---|---|---|

| RFN | Reference Number | string(128) | Transaction Reference Number to be used in a refund, can contain additional information | {"RFN":"klujhadsc9ph87asd"} |

| REF | Host reference Number | string(32) | Reference number to the sale from the provider systems, printed on receipt | {"REF":"12345"} |

| HRC | Host Response Code | string(64) | Response code from the payment processor | {"HRC":"ERR1"} |

| HRT | Host Response Text | string(999) | Response text from the payment processor | {"HRT":"INVALID CARD"} |

Refund

A refund transaction type allows the merchant to undo a sale, it uses the transaction request format. The POS must ensure that the correct 'RFN' Tag is sent when performing a refund.

Refund Request

{

"Request":

{

"Merchant": "00",

"TxnType": "R",

"AmtPurchase": 100,

"TxnRef": "1234567890",

"CurrencyCode": "AUD",

"CutReceipt": "0",

"ReceiptAutoPrint": "0",

"App": "00",

"PurchaseAnalysisData":

{

"RFN": "klujhadsc9ph87asd",

"OPR": "00766|test",

"AMT": "0042000",

"PCM": "0000"

}

},

"Notification":

{

"Uri": "https://myPos.com.au/{{sessionid}}/{{type}}",

"AuthorizationHeader": "Bearer <<token>>"

}

}

| Field Name | Type | Required value | Notes |

|---|---|---|---|

| Merchant | string(2) | '00' | Instructs the Linkly components to perform a card payment |

| TxnType | string(1) | 'R' | Purchase |

| AmtPurchase | number | Variable | Left zero filled, amount of sale in cents. |

| TxnRef | string(16) | Variable | The reference number to attach to the transaction. This will appear on the receipt. |

| CurrencyCode | string(3) | Variable | Code to indicate requested currency. e.g. 'AUD' |

| CutReceipt | string(1) | Variable | Indicates whether Linkly should cut receipts. Defaults to '0' (DontCut) |

| ReceiptAutoPrint | string(1) | Variable | Indicates if the POS is to receive receipt events. See ReceiptAutoPrint for available values |

| Application | string(2) | '00' | Instructs Linkly to perform a card payment |

| PurchaseAnalysisData | object | Variable | Extended fields. See PurchaseAnalysisData note below. |

| Basket | object | Variable | See basket section for details |

PurchaseAnalysisData

| Tag | Name | Type | Notes | Example |

|---|---|---|---|---|

| RFN | Reference Number | string(128) | Reference Number from purchase request this refund is for | {"RFN":"klujhadsc9ph87asd"} |

| OPR | OperatorReference | string(128) | POS operator name and id. Format: ID|Name | {"OPR": "66|test" } |

| AMT | TotalAmount | string(9) | Total amount of the entire sale in cents, not Tender amount | {"AMT": "20000" } $200.00 total sale |

| PCM | POSCapabilitiesMatrix | string(128) | POS Capabilities Matrix. First byte = POS can scan Barcode | {"PCM": "0000"} |

Refund Response

The refund response is in the format of the transaction response object, see the Transaction section for a detailed breakdown.

PurchaseAnalysisData

| Tag | Name | Type | Notes | Example |

|---|---|---|---|---|

| REF | Host reference Number | string(128) | Reference number to the sale from the provider systems, printed on receipt | {"REF":"12345"} |

| HRC | Host Response Code | string(64) | Response code from the payment processor | {"HRC":"ERR1"} |

| HRT | Host Response Text | string(999) | Response text from the payment processor | {"HRT":"INVALID CARD"} |

Management Functions

The management functions allow the merchant to perform utility functions in addition to sales. The minimum requirements for these are; Reprint Receipt and Transaction Status

Reprint Receipt

The reprint receipt function allows for the retrieval/reprint of a financial receipt. The 'Merchant' field must be set to a unique 2-character code to specify the sale processor, this is returned in the purchase/refund response.

Reprint Receipt Request

Example reprint receipt request object

{

"Request": {

"Merchant": "99",

"ReceiptAutoPrint": "0",

"ReprintType": "2"

},

"Notification":

{

"Uri": "https://myPos.com.au/{{sessionid}}/{{type}}",

"AuthorizationHeader": "Bearer <<token>>"

}

}

| Field Name | Type | Required value | Notes |

|---|---|---|---|

| Merchant | string(2) | '00' | Unique ID of third-party sale to fetch. Set to '99' to indicate generic reprint |

| CutReceipt | string(1) | Variable | Indicates whether Linkly should cut receipts. Defaults to '0' (DontCut) |

| ReceiptAutoPrint | string(1) | Variable | Indicates if the POS is to receive receipt events. See ReceiptAutoPrint for available values |

Reprint Receipt Response

See Reprint Receipt Response Object for response format

Transaction Status

This function returns the last transaction event processed by Linkly. This function can be called by a POS to determine whether a transaction was successful or not following a power failure whilst an EFTPOS transaction was in progress, this is part of the error handling scenarios.

See Transaction Status for request/response format

Transactional Scenarios

Partial/Split Payments

Partial and split payments must be handled by the POS, when sending a purchase request the POS must set the 'AMT' Tag with the total amount of the entire sale the 'AmtPurchase' field should be set to the actual tender amount, in most cases these fields will be equal. When receiving a response the POS will receive the 'AmtPurchase' field set to the amount the sale was processed for if the POS receives an amount less than what was sent in the response it must continue to make payments until the entire tender is payed for.

Example 1

- POS sets AMT PurchaseAnalysisData tag to 4000 - Total sale for $40.00

- POS sets AmtPurchase = 2000 – Tender amount set to $20.00

- Process sale

- POS receives AmtPurchase = 2000 – Payment completed for $20.00

- POS sets AmtPurchase = 2000 and AMT PurchaseAnalysisData tag to 4000 – Create another sale for $20.00

- Process Sale

- POS receives AmtPurchase = 2000 – Payment completed for $20.00

- Tender complete

Example 2

- POS sets AMT PurchaseAnalysisData tag to 2000 = Total Sale for $20.00

- POS sets AmtPurchase = 2000 = Tender amount set to $20.00

- Process sale

- POS receives AmtPurchase = 1000 - Payment completed for $10.00

- POS sets AmtPurchase = 1000 and AMT PurchaseAnalysisData tag to 2000 – Create another sale for $10.00

- Process Sale

- POS receives AmtPurchase = 1000 – payment completed for $10.00

- Tender complete

Error Handling

The POS should implement error handling as outlined by the Error recovery section.

Optional Functionality

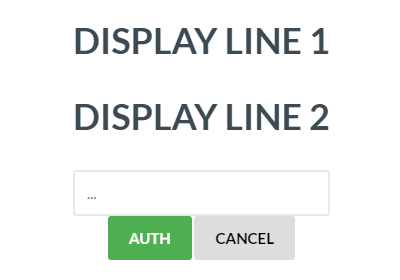

Custom Displays

To implement custom display the POS must implement the async API and handle the Display Response notification and Send Key request

If the POS is handling its own displays, it must implement the following:

- 2-line, 20 character. No keys enabled. Input type 0. Graphics code 0 to 6.

- 2-line, 20 character. Cancel key enabled. Input type 0. Graphics code 0 to 6.

- 2-line, 20 character. OK key enabled. Input type 0. Graphics code 0 to 6.

- 2-line, 20 character. Accept + decline key enabled. Input type 0. Graphics code 0 to 6.

- 2-line, 20 character. Auth + cancel key enabled. Input type 1. Graphics code 0 to 6.

Input types:

- '1'= Normal ASCII input

Example displays

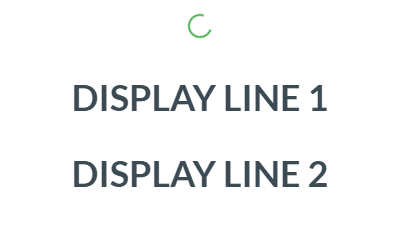

No keys enabled

{

"ResponseType": "display",

"Response": {

"NumberOfLines": 2,

"LineLength": 20,

"DisplayText": [

"DISPLAY LINE 1",

"DISPLAY LINE 2"

]

}

}

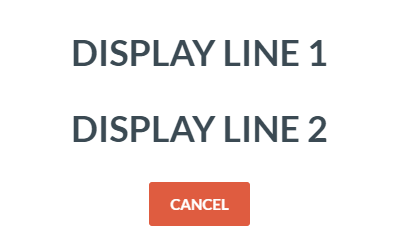

Cancel key enabled

{

"ResponseType": "display",

"Response": {

"NumberOfLines": 2,

"LineLength": 20,

"DisplayText": [

"DISPLAY LINE 1",

"DISPLAY LINE 2"

],

"CancelKeyFlag": true

}

}

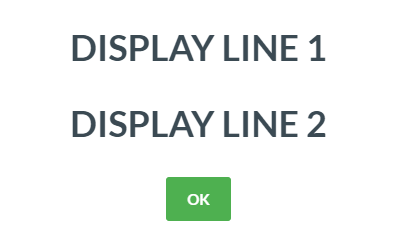

OK key enabled

{

"ResponseType": "display",

"Response": {

"NumberOfLines": 2,

"LineLength": 20,

"DisplayText": [

"DISPLAY LINE 1",

"DISPLAY LINE 2"

],

"OKKeyFlag": true

}

}

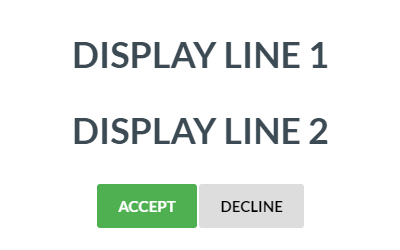

Accept/decline keys enabled

{

"ResponseType": "display",

"Response": {

"NumberOfLines": 2,

"LineLength": 20,

"DisplayText": [

"DISPLAY LINE 1",

"DISPLAY LINE 2"

],

"AcceptYesKeyFlag": true,

"DeclineNoKeyFlag": true

}

}

Auth input enabled

{

"ResponseType": "display",

"Response": {

"NumberOfLines": 2,

"LineLength": 20,

"DisplayText": [

"DISPLAY LINE 1",

"DISPLAY LINE 2"

],

"CancelKeyFlag": true,

"AuthoriseKeyFlag": true,

"InputType": "1"

}

}

POS Barcode Scanning

This function allows the POS to scan a barcode instead of the PIN pad. The POS will receive a DisplayEvent and must answer with a SendKey; populating the DataEntry field this will be the Barcode for the sale. POS must set the PCM PAD tag's first byte to '1' to indicate it can support this functionality and wants to use it for the transactions.

Transaction Request

Perform a sale with the following Purchase Analysis Data Tag:

| Tag Name | Tag Value | Description | Example |

|---|---|---|---|

| PCM | Flag array of functionality supported by POS | POS Capabilities Matrix. First byte = POS can scan Barcode | PCM0011 |

This will cause the EFT-Client to send a DisplayEvent to the POS with the following properties:

Display Event

| Field Name | Length (characters) | Description | Example |

|---|---|---|---|

| NumberOfLines | 2 | Number of lines of text | '02' – two lines |

| LineLength | 2 | Length of each line of text | '20' line is 20 char long |

| DisplayText | 40 | Text to display | 'SCAN BARCODE' |

| Cancel Key Flag | 1 | Indicates whether the CANCEL key can be pressed | '0' = Disabled '1' = Enabled |

| InputData Field Key | 1 | See 'Custom Displays' Section | '7' |

| OK Key Flag | 1 | Indicates whether the OK key can be pressed | '0' = Disabled '1' = Enabled |

The POS must reply to the above display event with a SendKey Request as detailed below:

Send Key Request

| Field Name | Length (characters) | Description | Example |

|---|---|---|---|

| Key | 1 | Indicated which key is to be pressed '0' for the CANCEL key '1' for the YES key '2' for the NO key '3' for the AUTH key | '0' = CANCEL |

| Data | 60 | Entry data collected by POS (the barcode) | 209849083 |

Linkly Basket

The "basket" in the transaction request contains information about items in the transaction.

Basket Command Header Fields

{

"id": "t39kq18134553",

"amt": 17890,

"tax": 1790,

"dis": 1000,

"sur": 358,

"items": [...]

}

The basket header contains meta information about the basket, along with the id for the basket which is needed when sending a transaction with basket data, or when changing the basket.

| Name | Required | Description | Format |

|---|---|---|---|

| id | Y | A unique ID for the basket | String, max 32 |

| amt | Y | Total price for the basket, in cents, including tax and discount, but excluding surcharge | Integer |

| tax | Total tax for the basket, in cents | Integer | |

| dis | Total discount for the basket, in cents | Integer | |

| sur | Surcharge (e.g. for Credit Card), in cents | Integer | |

| items | Y | Array of basket items | JSON array |

Basket Command Item Fields

Example basket item data object

{

"id": "t39kq002",

"sku": "k24086723",

"qty": 2,

"amt": 2145,

"tax": 200,

"dis": 50,

"gtin": "831664397578",

"name": "XData USB Drive",

"desc": "24GB XData USB Drive, Red/Black",

"srl": "xd546467",

"img": "http://www.xdata.com/products/images/usb24_rb_1.jpg",

"link": "http://www.xdata.com/products.php&pid=usb24_rb",

"tag": "usb drive,storage"

}

The basket items are required to have at least an id, sku, quantity, and price of the item included in the item data.

Other fields can be used as desired by vendors.

| Name | Required | Description | Format |

|---|---|---|---|

| id | Y | A unique ID for the item | String, max 32 |

| sku | Y | Merchant assigned SKU for the item | String |

| qty | Y | Quantity (number of units) | Integer |

| amt | Y | Individual unit price for the item, in cents, including tax and discount | Integer |

| tax | Individual unit tax for the item, in cents | Integer | |

| dis | Individual unit discount for the item, in cents | Integer | |

| ean | The EAN (European Article Number) for the item | String | |

| upc | The UPC (Universal Product Code) for the item | String | |

| gtin | The GTIN (Global Trade Item Number) for the item | String | |

| name | A short name for the item | String, max 24 | |

| desc | A longer description for the item | String, max 255 | |

| srl | Serial code, or other identifying code, for the item | String | |

| img | URL to an image for the item | String | |

| link | URL to a product page for the item | String | |

| tag | Comma separated category or type information for the item (e.g. "food, confectionery”) | String, max 64 |

Basket Command Extended Item Fields

{

"id": "t39kq001",

"sku": "s63787452",

"qty": 1,

"amt": 1995,

"weight": "2kg"

}

In additional to the required and optional fields, an item may also include one or more extended fields for use by specific third parties. Extended fields are simply included along with the standard fields for the item.

The example opposite includes "weight”, with a value of "2kg”, as an extended field.

See the appropriate Linkly Third Party Processor (TPP) specification for a list of supported extended fields.

Basket Command Full Example

Full Basket Example

{

"id": "t39kq18134553",

"amt": 18700,

"tax": 1760,

"dis": 650,

"sur": 374,

"items": [{

"id": "t39kq002",

"sku": "k24086723",

"qty": 2,

"amt": 2145,

"tax": 200,

"dis": 50,

"name": "XData USB Drive"

}, {

"id": "t39kq003",

"sku": "s23475697",

"qty": 1,

"amt": 8910,

"tax": 810,

"name": "MSoft OSuite",

"srl": "ms7843k346j23"

}, {

"id": "t39kq004",

"sku": "m47060855",

"qty": 5,

"amt": 1100,

"tax": 110,

"dis": 110,

"name": "A4 Notepad"

}]

}

The example opposite basket contains 3 items:

2 XData USB Drives, at $21.45 each, which includes tax of $2.00 and a discount of $0.50

1 MSoft OSuite, with a serial number, at $89.10, which includes tax of $8.10 and no discount

5 A4 Notepads, at $11.00 each, which includes tax of $1.10 and a discount of $1.10

The total value of the basket is $187.00, with a total tax of $17.60 and total discount of $6.50. Paying by credit card also incurred a surcharge of $3.74 (2%).

Surcharging

The Linkly surcharging solution is driven by the Linkly components and the payment terminal, this removes any need for the POS application to perform any complex card inspection or store and managed surcharging rates. Merchants can us the Linkly Merchant Portal to set their desired surcharging rates.

If a surcharge is applied:

- the SUR PAD tag will be present in the transaction response, and will contain the value of the surcharge applied in cents.

- the AMT PAD tag will be present in the transaction response, and will contain the total value of the sale (e.g. purchase amount + surcharge + tip)

Food & Beverage

Linkly has created a number of payment features that help merchants make the most of their payment solution, these help POS providers quickly add important features to their food and beverage solution.

Pay at Table

The Linkly Pay at Table solution groups a number of payment features together to deliver the capability to process payment transactions at a table, the capabilities include:

- Initiate the transaction from the payment terminal

- Split billing across multiple parties

- Collect tips as part of the transaction

- Print receipts at the table

As the Pay at Table flow creates an alternate transaction flow (commenced from the terminal), there are dedicated Linkly features to enable.

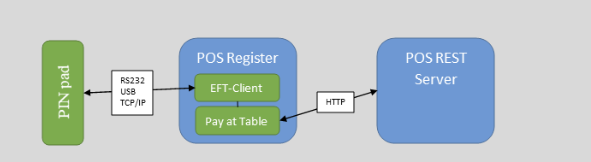

Overview

The Pay at Table API provides a common interface for the terminal to utilise the EFT-Client to retrieve available tables and orders so payment functions (e.g. tender, customer receipt etc.) can be performed by an operator on the terminal without using the POS.

The Pay at Table client requires the POS to act a data source so that it can retrieve information about available tables, orders, payment options etc.

POS Data Source - REST Server

When in REST server mode the Pay at Table extension will connect directly to a REST server hosted by the POS which implements the Linkly Pay at Table REST API.

Example Transaction Flow

- The user initiates a Pay at Table transaction from the terminal

- The Linkly Pay at Table client requests the settings from the server

- The Linkly Pay at Table client requests a list of tables from the server

- Tables are presented to the user, either as a list using the DisplayName property of a Table or by allowing the user to manually key a DisplayNumber.

- Once the user selects a table, the Pay at Table client requests orders available on that table.

- If no orders are available, the Pay at Table client presents a display to the user and allows them to select another table.

- If orders are available the Pay at Table client presents available options for that order (e.g. print receipt, tender). If multiple orders are available, the Pay at Table client displays all available orders and asks the user to select which order to process.

- If the user selects the "Print Receipt" option, the Pay at Table client will request the customer receipt from the server, print it and display the order options again. If multiple print options are available from the settings, the user is asked to select which mode to print before the request is sent to the server.

- If the user selects the "Tender" option, the Pay at Table client starts a payment on the terminal. If multiple tender options are available from the settings, the Pay at Table client displays these options and asks the user to select the tender type before proceeding with the payment.

- The transaction request, display events and transaction event are sent to the server as EFTPOS commands

- Once the payment is complete, the Pay at Table client updates the tender with a completed state. It is assumed at this point the POS server would also update the order state.

- The Pay at Table client request the selected order again. If the order is complete a message is displayed on the terminal, otherwise the user is presented with the order options again.

POS Data Source - Linkly Interface

Linkly recommend the POS implements REST server mode. If the REST server mode doesn't suit your integration needs, please contact Linkly to discuss alternatives.

The POS must manage the order/tender states in case of disconnection from the Pay at Table client or the terminal. If the POS loses connection from the service at any time while a tender/order is being processed, it's recommended to inquire of the last transaction's status using the GetLastTransaction call to the EFT-Client.

Start Developing

Install required software

- Enable Pay at Table in your Linkly Cloud account

- Set up a Pay at Table REST demo application

- Start a Pay at Table sale from the PINpad

Set up Pay at Table

- Download the latest release candidate Linkly Software and install the "Offline Development" components

- DevTools will be installed to C:\PC_EFT\DevTools

- The VirtualPinpad.exe can be launched from the start menu

- Download and install the latest release candidate Linkly Pay at Table Software

- Set up a Pay at Table demo using either the REST or local Linkly API demo application

- Start a Pay at Table sale from the PINpad

REST Demo Application

To configure the REST Demo Application

- Download the REST demo source from GitHub

- Run Visual Studio 2019 as Administrator

- Open and build the project "PayAtTable.ServerCore" in Visual Studio

- Open the Project Properties, and under Debug, take note of the App URL

- When you run the Linkly Pay at Table installer, enable the REST API option and enter the App URL as the server address

- Run the project using IIS Express. The browser should open showing the Settings launch page. When you click on Swagger, it will show the available APIs.

Start a Pay at Table Sale

- Configure REST demo application

- On the Virtual PINpad, press FUNC + 8787 + OK

- Follow PINpad prompts

Pay at Table REST API

Linkly has created a lightweight solution for driving Pay at Table transactions which the POS needs to implement so the transactions can be commenced from the terminal.

HTTP Response codes

| HTTP Response code | Description |

|---|---|

| 200 OK | The request was successful |

| 201 Created | The request was successful, and a resource has been created |

| 204 No Content | The request was successful, there is no content in the response |

| 400 Bad Request | The client request is invalid |

| 401 Unauthorised | The client needs to authenticate before it can continue |

| 403 Forbidden | The client doesn't have access to the resource |

| 404 Not found | The requested resource wasn't found |

| 500 Server Error | The server encountered an internal error processing the request |

Methods

| Name | HTTP Method | Description |

|---|---|---|

| Get Settings | GET /api/settings | Get settings for the Pay at Table client |

| Get Tables | GET /api/tables | Get a lookup list of tables used to find an order |

| Get Orders By Table | GET /api/tables/{table-id}/orders | Get a list of orders associated with a table |

| Get Order | GET /api/orders/{order-id} | Get an order based on an order id. |

| Get Customer Receipt From Order | GET /api/orders/{order-id}/receipt?receiptOptionId=[string] | Get a customer receipt for a given order. Can accept an optional receipt option id. |

| Update Order | PUT /api/orders/{order-id} | Update an order |

| Create Tender | POST /api/tenders | Create a tender |

| Update Tender | PUT /api/tenders/{tender-id} | Update a tender |

| Create EFTPOS Command | POST /api/eftpos/commands | Create an EFTPOS command |

Get Settings

GET /api/settings

HTTP/1.1 200 OK

Content-type: application/json

{

"Settings": {

"TenderOptions": [{

"Id": "0",

"TenderType": 0,

"Merchant": "0",

"DisplayName": "EFTPOS",

"EnableSplitTender": false,

"EnableTipping": true,

"CsdReservedString2": "EFTPOS",

"TxnType": "P",

"PurchaseAnalysisData": ""

}],

"ReceiptOptions": [{

"Id": "0",

"ReceiptType": 0,

"DisplayName": "Customer"

}],

"PrinterOption": {

"PrintMode": 0,

"Location": -1,

"StaticReceipt": ["line1", "line2", "line3", "line4"]

}

}

}

Description

Get the settings for the pay at table client

Request

Do not supply a request body for this method.

Response

If successful, the body contains a PATResponse object with the Settings property populated a Settings object.

Supported response codes: 200, 400, 401, 403 and 500.

Properties

| Name | Type | Description |

|---|---|---|

| TenderOptions | TenderOption[] | Lists the tender options available to the Pay at Table client. If left null or empty the option to tender will not be available on Pay at Table client when the user selects an order. If only one option is available, the Pay at Table client will automatically select that option when the user chooses to tender. |

| ReceiptOptions | ReceiptOption[] | Lists the tender options available to the Pay at Table client. If left null or empty the option to print will not be available on Pay at Table client when the user selects an order. If only one option is available, the Pay at Table client will automatically select that option when the user chooses an order. |

| PrinterOption | PrinterOption | Allows for custom receipt information, appended to the header/footer of the eftpos receipt, if left null no custom receipt will be printed. You can allow Linkly to print a custom header/footer with some information about the current Transaction |

TenderOption Properties

| Name | Type | Description |

|---|---|---|

| Id | String | Unique identifier. |

| TenderType | int | The type of this tender option |

| Merchant | int | The merchant code to use (see Appendix A - Merchant Codes). Default is 0. |

| DisplayName | String | The text displayed in the terminal. |

| EnableSplitTender | Boolean | If true, the split-billing workflow is enabled. |

| EnableTipping | Boolean | If true, the tipping workflow is enabled. |

| CsdReservedString2 | String | A Reserved String for additional functionality (see CsdReservedString2). Default is EFTPOS. |

| TxnType | String | The type of transaction this tender applies to. Only Purchase and Refund types are allowed. |

| PurchaseAnalysisData | String | any additional PAD value |

ReceiptOption Properties

| Name | Type | Description |

|---|---|---|

| Id | String | Unique identifier. |

| ReceiptType | int | The type of receipt for this tender option. Only 0 is supported for now. |

| DisplayName | String | The text displayed in the terminal. |

PrinterOption Properties

| Name | Type | Description |

|---|---|---|

| PrintMode | int | Determines who will handle the header/footer receipt printing, default PCEFTPOS: PCEFTPOS = 0, POS = 1, STATIC = 2. |

| Location | int | Determines where the custom receipt will print as a header prior to eftpos receipt or after as a footer, default is None: Header = 0, Footer = 1, None = -1. |

| StaticReceipt | String[] | The receipt to display if you set PrintMode to STATIC. |

Get Tables

GET /api/tables

HTTP/1.1 200 OK

Content-type: application/json

{

"Tables": [{

"Id": "50",

"DisplayName": "TABLE 1",

"DisplayNumber": 1,

"ServerName": "Steve"

},

{

"Id": "51",

"DisplayName": "TABLE 2",

"DisplayNumber": 2,

"ServerName": "Steve"

},

{

"Id": "52",

"DisplayName": "TABLE 3",

"DisplayNumber": 3,

"ServerName": "Jake"

}

]

}

Description

Get a lookup list of tables used to find an order. The Pay at Table client will either present a list of selectable items to the user using the "DisplayName" property, or request the user enter a number which will be used to find a table based on the "DisplayNumber" property. The Id property is a unique identifier for the table used in subsequent requests and is not presented to the user.

Request

Do not supply a request body for this method.

Response

If successful, the body contains a PATResponse object with the Tables property populated by an array of Table.

Supported response codes: 200, 400, 401, 403 and 500.

Properties

| Name | Type | Description |

|---|---|---|

| Id | String | Unique identifier. |

| DisplayName | String | Max 14 characters. A name which represents this table that could be displayed to a user. |

| DisplayNumber | Integer | A number which represents this table that could be displayed to a user. |

| ServerName | String | Max 8 characters. A string that represents either the servers name or employee ID. |

Get Orders by Table

GET /api/tables/{table-id}/orders

HTTP/1.1 200 OK

Content-type: application/json

{

"Orders": [{

"Id": "101",

"DisplayName": "Elsa",

"OrderState": 0,

"AmountOwing": 100.00,

"TableId": "50"

}]

}

Description

Get a list of orders associated with a table.

The Pay at Table client will send this request after a user has selected one of the tables returned from a previous call to Get Tables.

Request

GET /api/tables/{table-id}/orders

Do not supply a request body for this method

| Parameter | Type | Description |

|---|---|---|

| table-id | String | Required. The id of an table orders are being requested from. |

Response

If successful, the body contains a PATResponse object with the Orders property populated by an array of Order.

Supported response codes: 200, 400, 401, 403 and 500.

Properties

| Name | Type | Description |

|---|---|---|

| Id | String | Unique identifier. Read only. |

| DisplayName | String | Max 14 characters. A name which represents this table that could be displayed to a user. |

| OrderState | Integer | The state of the order. This is used by the Pay at Table client to determine if an order is available for tender. Possible values: (0) Pending – The order exists, but isn't yet available for tender. (10) Active – The order exists and is available for tender. (20) Tendering – A tender is currently in progress. The result is not known. The order is not available for tender. (30) Complete – The order is complete and is not available for tender. |

| AmountOwing | Decimal | The outstanding amount on this order. This is used by the Pay at Table client to determine the maximum tender amount. |

| TableId | String | The id of the Table attached to this order. |

Get Order

GET /api/orders/{order-id}

HTTP/1.1 200 OK

Content-type: application/json

{

"Order": {

"Id": "101",

"DisplayName": "Elsa",

"OrderState": 0,

"AmountOwing": 100.00,

"TableId": "50"

}

}

Description

Get an order based on an order id.

The Pay at Table client will send this request after a user has selected one of the orders returned from a previous call to Get Orders by Table.

Request

Do not supply a request body for this method.

| Parameter | Type | Description |

|---|---|---|

| order-id | String | Required. The id of the order being requested. |

Response

If successful, the body contains a PATResponse object with the Order property populated by an Order.

Supported response codes: 200, 400, 401, 403, 404 and 500.

Properties

| Name | Type | Description |

|---|---|---|

| Id | String | Unique identifier. Read only. |

| DisplayName | String | Max 14 characters. A name which represents this table that could be displayed to a user. |

| OrderState | Integer | The state of the order. This is used by the Pay at Table client to determine if an order is available for tender. Possible values: (0) Pending – The order exists, but isn't yet available for tender. (10) Active – The order exists and is available for tender. (20) Tendering – A tender is currently in progress. The result is not known. The order is not available for tender. (30) Complete – The order is complete and is not available for tender. |

| AmountOwing | Decimal | The outstanding amount on this order. This is used by the Pay at Table client to determine the maximum tender amount. |

| TableId | String | The id of the Table attached to this order. |

Get Customer Receipt from Order

GET /api/orders/{order-id}/receipt?receiptOptionId=[string]

HTTP/1.1 200 OK

{

"Receipt": {

"Lines": ["Line 1","Line 2","Line 3"]

}

}

Description

Get a customer receipt based on an order id.

Request

Do not supply a request body for this method

| Parameter | Type | Description |

|---|---|---|

| order-id | String | Required. The id of the order the receipt is being requested from. |

| receiptOptionId | String | Optional. The id of the ReceiptOption used to generate this receipt request. Note: id '99' is reserved for custom header/footer receipt from POS |

Response

If successful, the body contains a PATResponse object with the Receipt property populated by a Receipt.

Supported response codes: 200, 400, 401, 403, 404 and 500.

Update Order

PUT /api/orders/{order-id}

Content-type: application/json

{

"Order": {

"Id": "200",

"DisplayName": "Order 99",

"OrderState": 30,

"AmountOwing": 0.00,

"TableId": "50"

}

}

HTTP/1.1 200 OK

Content-type: application/json

{

"Order": {

"Id": "200",

"DisplayName": "Order 99",

"OrderState": 30,

"AmountOwing": 0.00,

"TableId": "50"

}

}

Description

Updates an order. This is called before the Create Tender to mark the order as Tendering. If the update is successful, the Create Tender is called next. It is called again after a payment has been processed to mark the status of the order. The AmountOwing and OrderState will be updated according to the result of the payment. For example, if the payment was fully paid, the order will be updated as Completed and the AmountOwing is set as zero. If the payment is partial, it will be set again to Active and the AmountOwing will reflect the remaining balance. If the payment was canceled, the status will be set to Active and the AmountOwing will remain the same.

The Id property must point to a valid order and match the {order-id} in the request URL.

Request

The request body contains a PATRequest with the Tender property populated by a Tender.

| Parameter | Type | Description |

|---|---|---|

| order-id | String | Required. The id of the order being updated. |

Response

If successful, this method returns a PATResponse object with the Order property populated by a Order. In most cases the Order in the response will mirror the request.

Properties

| Name | Type | Description |

|---|---|---|

| Id | String | Unique identifier. Read only. |

| DisplayName | String | Max 14 characters. A name which represents this order that could be displayed to a user. |

| OrderState | Integer | The state of the order. This is used by the Pay at Table client to determine if an order is available for tender. Possible values: (0) Pending – The order exists, but isn't yet available for tender. (10) Active – The order exists and is available for tender. (20) Tendering – A tender is currently in progress. The result is not known. The order is not available for tender. (30) Complete – The order is complete and is not available for tender. |

| AmountOwing | Decimal | The outstanding amount on this order. This is used by the Pay at Table client to determine the maximum tender amount. |

| TableId | String | The id of the Table attached to this order. |

Create Tender

POST /api/tenders

{

"Tender": {

"Id" : null,

"OrderId": "101",

"TenderOptionId": "0",

"TenderState": 0,

"AmountPurchase": 100.00,